Tax Act

Here’s how to claim the K-12 Education Tax Credit if you’re using TaxAct to file your taxes.

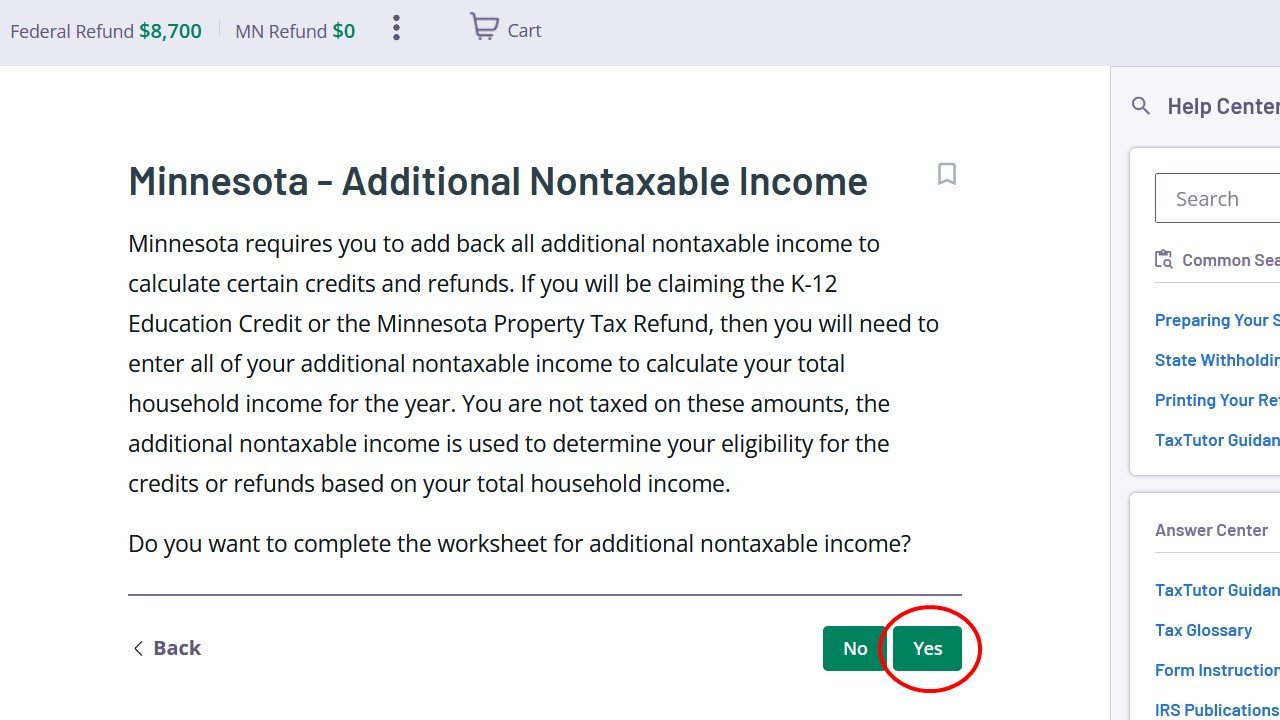

1. In the Minnesota portion of your tax return, when asked if you want to complete the worksheet for additional nontaxable income, click Yes.

2. Click Add M1.

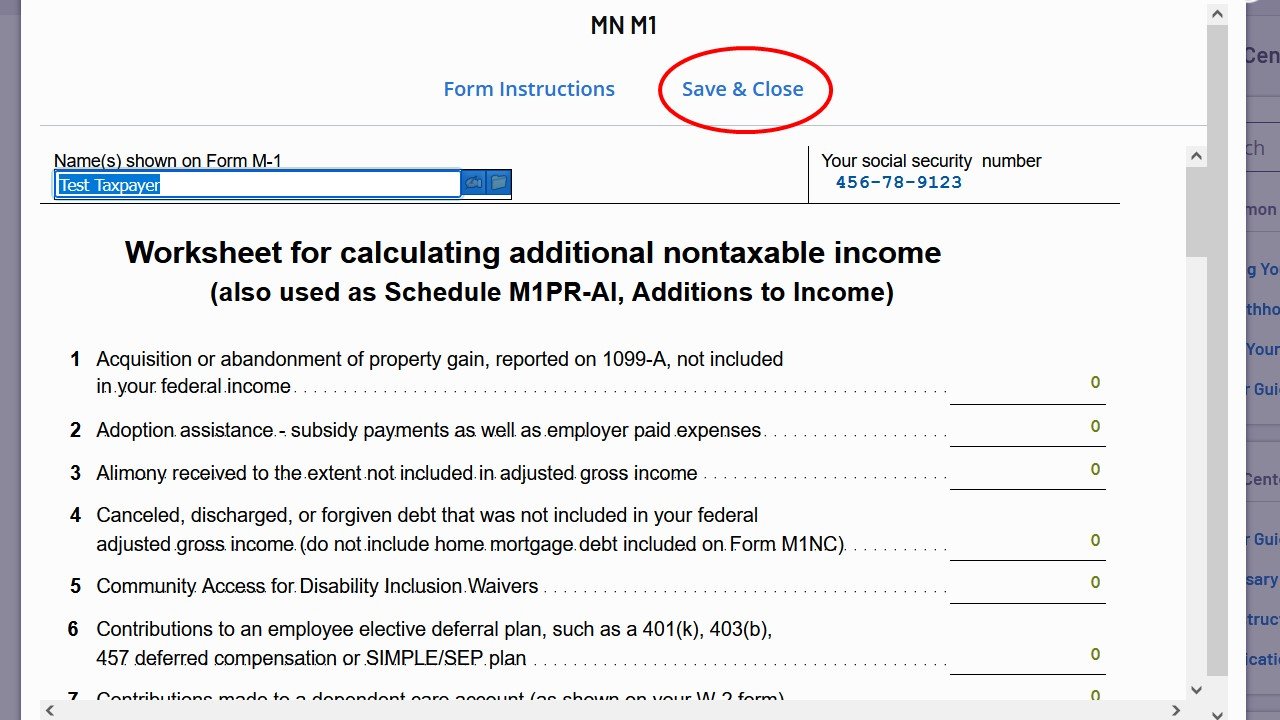

3. If you received any of the types of income listed, enter the amount on that line. When you’re done, click Save & Close, and then click Continue.

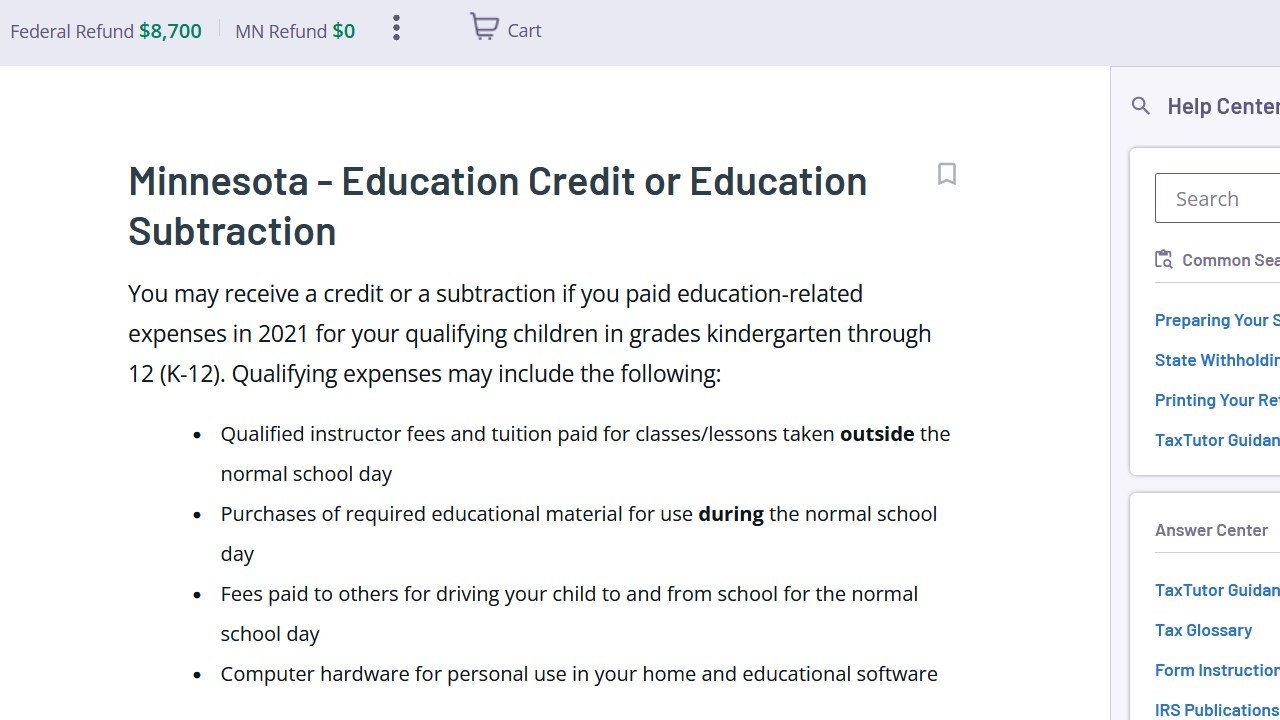

4. When you see the screen for Minnesota - Education Credit or Education Subtraction, click Yes.

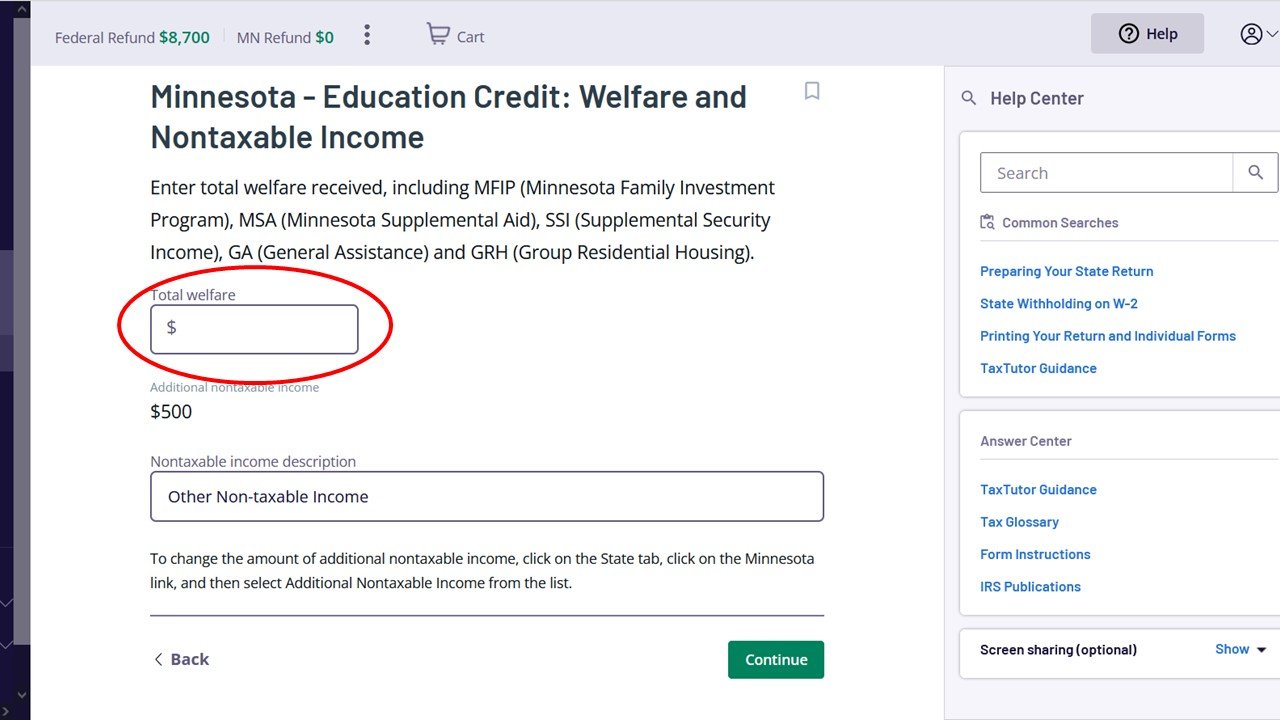

5. If you received any of the forms of government assistance listed, enter the total amount you received in the “Total Welfare” box. If you didn’t receive any, enter $0 in the box. Then, click Continue.

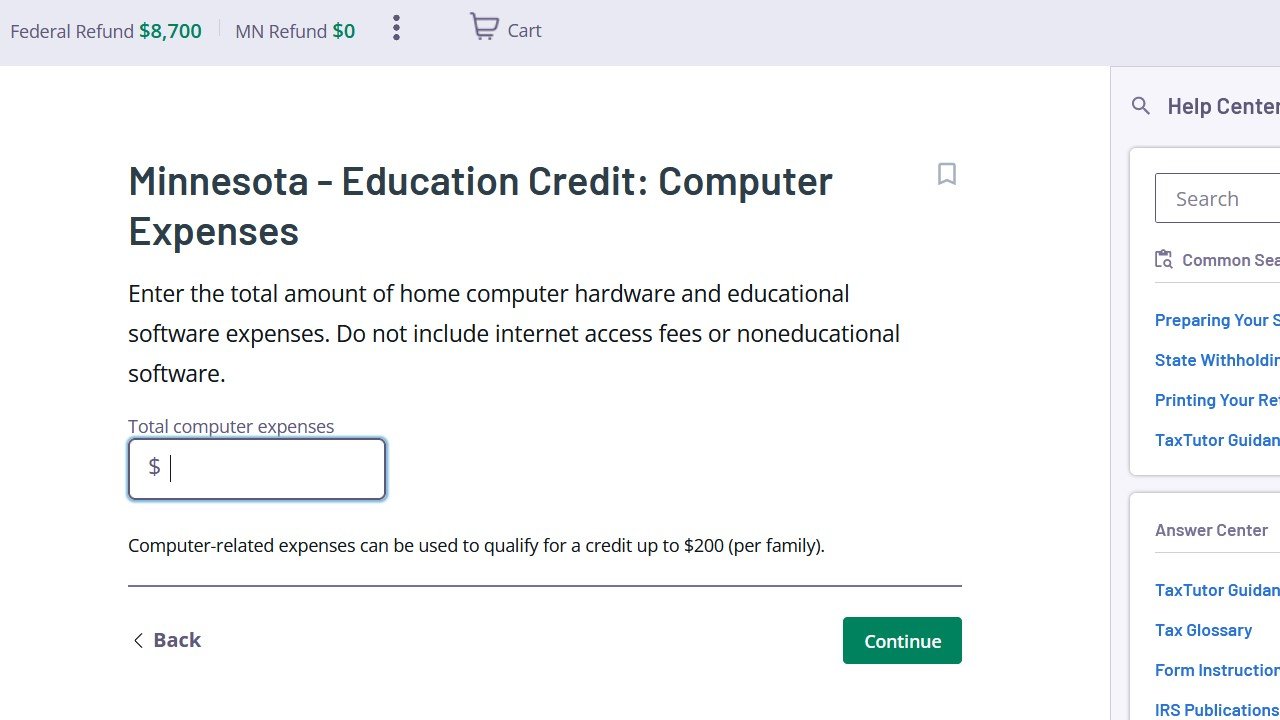

6. If you received a Chromebook from MAA this past year, look for the blue receipt for the Chromebook we sent you in the big green envelope. Find the line on the receipt that says “Use this amount on Form M1ED.” Enter the amount in the computer in the box that says Total Computer Expenses. If the amount is more than $200, only enter $200. Then click Continue.

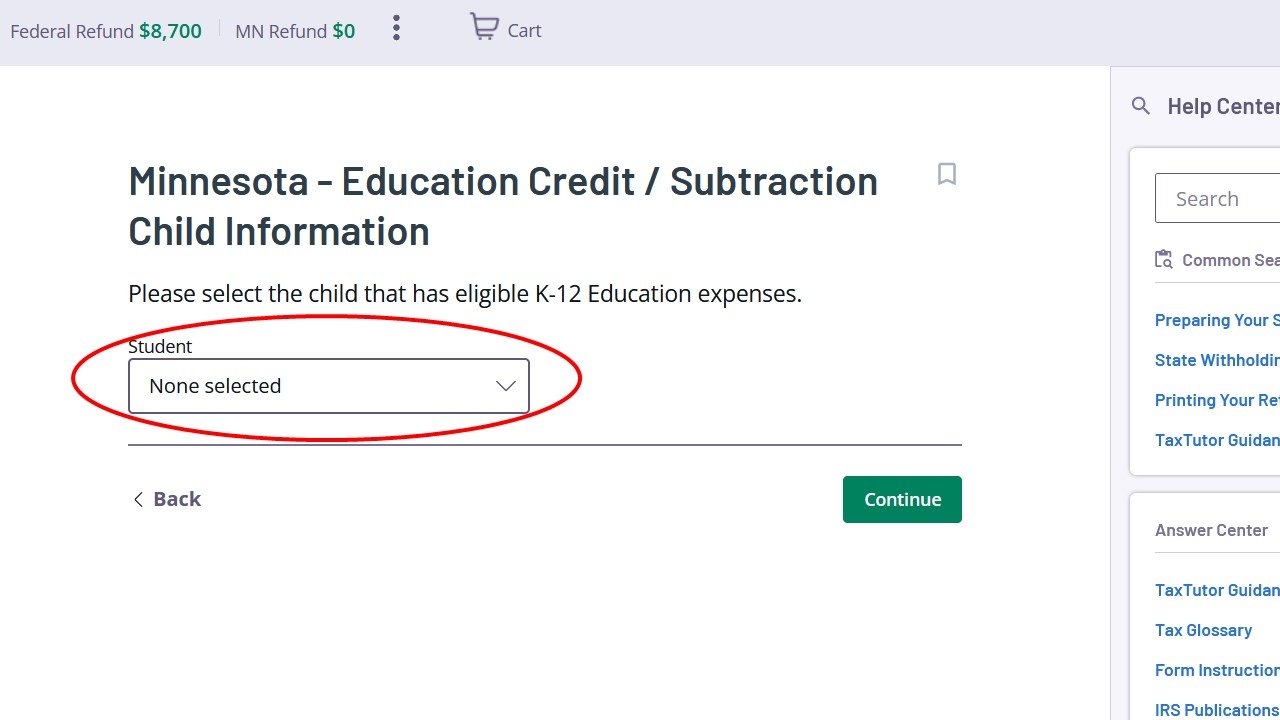

7. If you have a student who participated in afterschool or summer activities through MAA this past year, select the first child you want to enter information for, and click Continue.

8. Select that student’s grade and type of school. Then click Continue.

9. Did the student participate in a class or activity with other students? Add up the amount from the line that says “Use this amount on Form M1ED” on each blue receipt for that student and that type of activity. Enter the total in the box that says Enrichment Fees. Enter the name of the organization and type of class as well. Then click Continue.

10. Did the student participate in an individual activity like tutoring or music lessons? Add up the amount from the line that says “Use this amount on Form M1ED” on each blue receipt for that student and that activity. Enter the total in the box that says Fees. Enter the organization or instructor’s name and type of class in the appropriate boxes. Then click Continue.

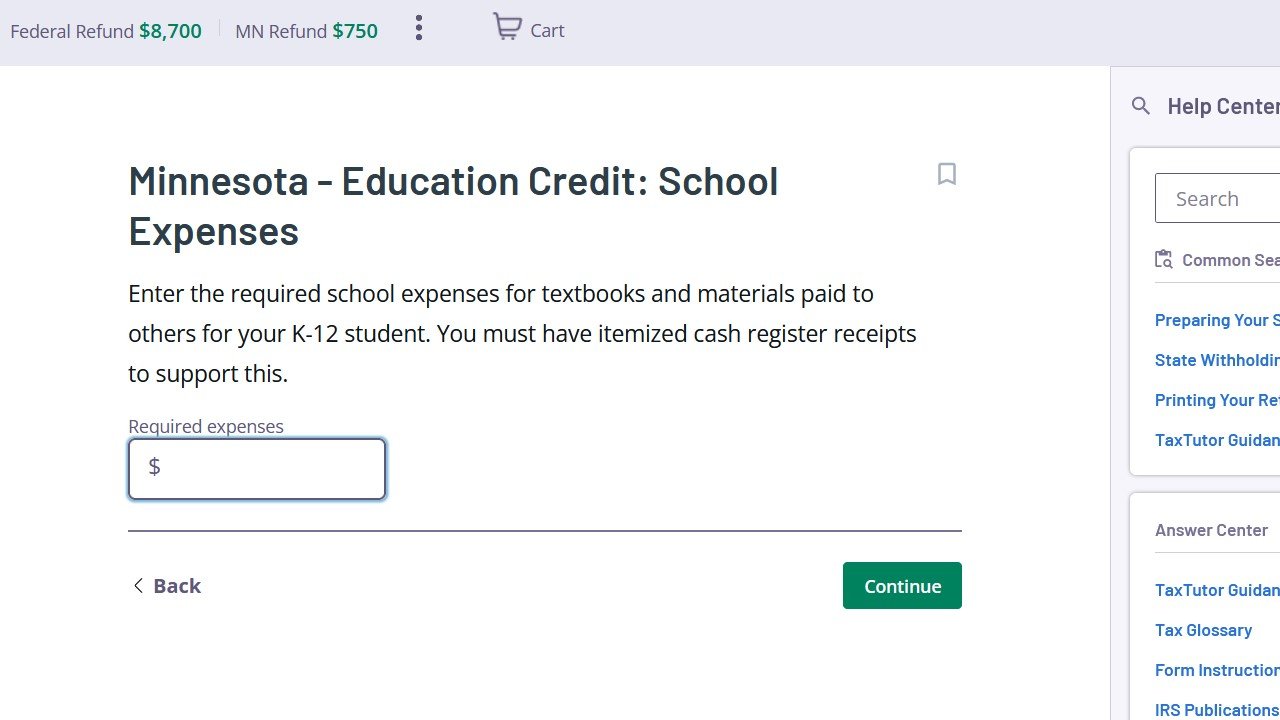

11. If you had any school expenses, like school supplies, this past year, you can enter them here. You must have itemized cash register receipts to claim these expenses. Then click Continue.

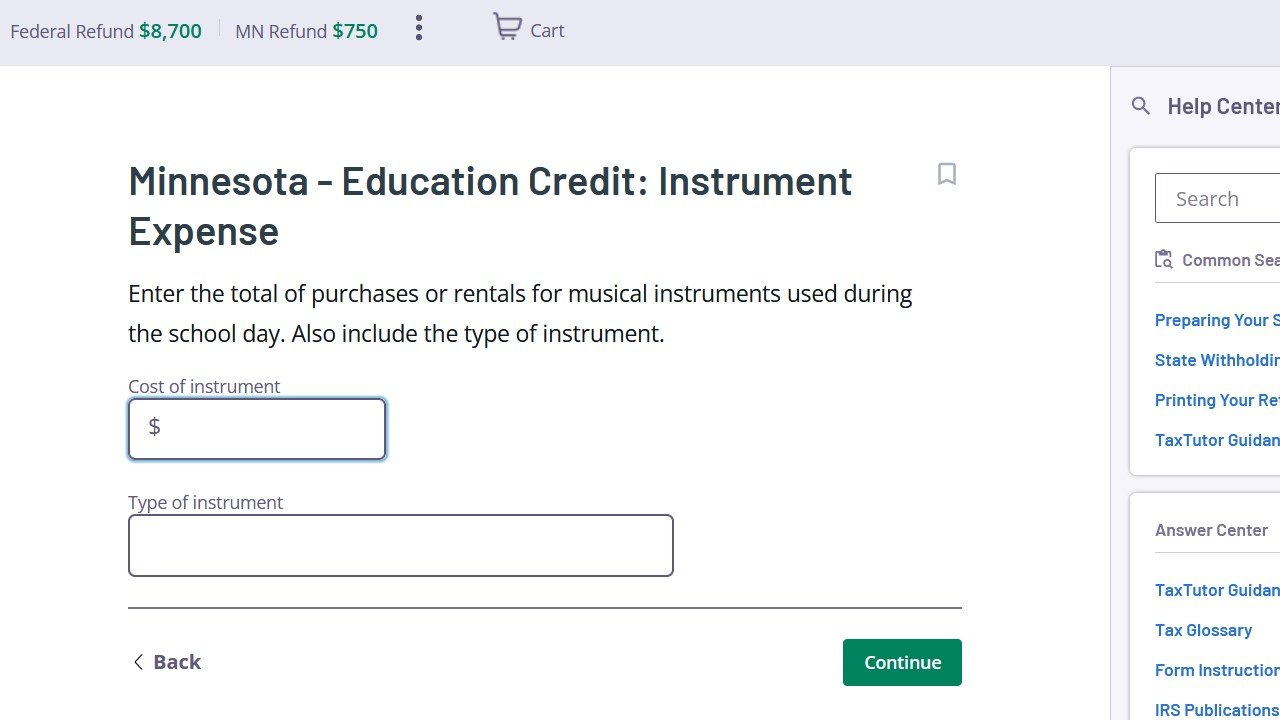

12. If you purchased or rented a musical instrument this year for your student to use during the school day (like for school band class), enter that information here. Then click Continue.

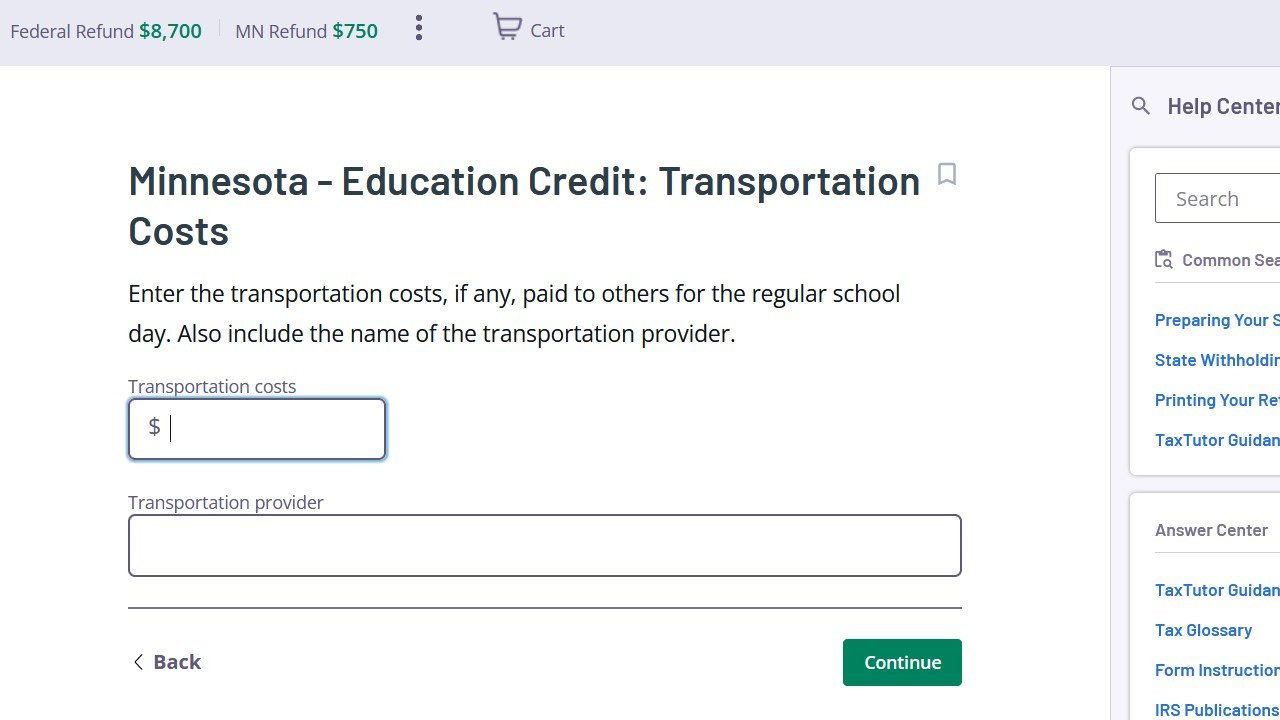

13. If you paid someone else to transport your student to school, enter that information here. Then click Continue.

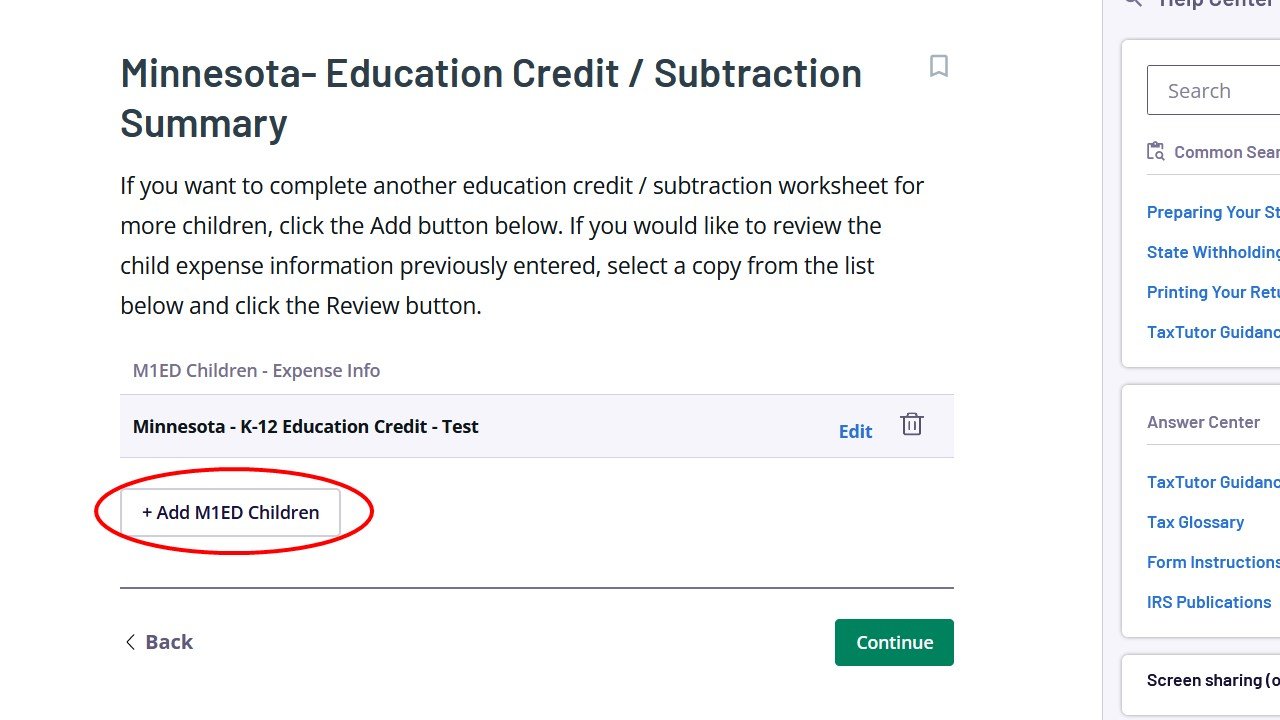

14. If you have more than one student who participated in activities through MAA this year, click Add M1ED Children to add info about more students. Otherwise, click Continue to finish the rest of your state tax return.

Questions

MAA cannot provide tax advice, but if you have questions about the materials we sent you or using this software, please contact our MAA team at maa@youthprise.org or 612-440-9342.