Applications are currently closed and MAA is currently on hold.

Please read this update for more information.

Questions about how MAA works? Watch a short video that explains it!

WHAT HAPPENS AFTER I APPLY?

Once we receive your application, we’ll review it to check for eligibility and if approved, we’ll send you an acceptance email. This process typically takes about 1 week. It can sometimes take longer if there are questions or clarifications necessary before we proceed.

Once approved, you will be notified via email. Service providers will also receive notice. Once you pay the required family contribution of 25% of the price of the activities, MAA will add its 75% to the child’s account.

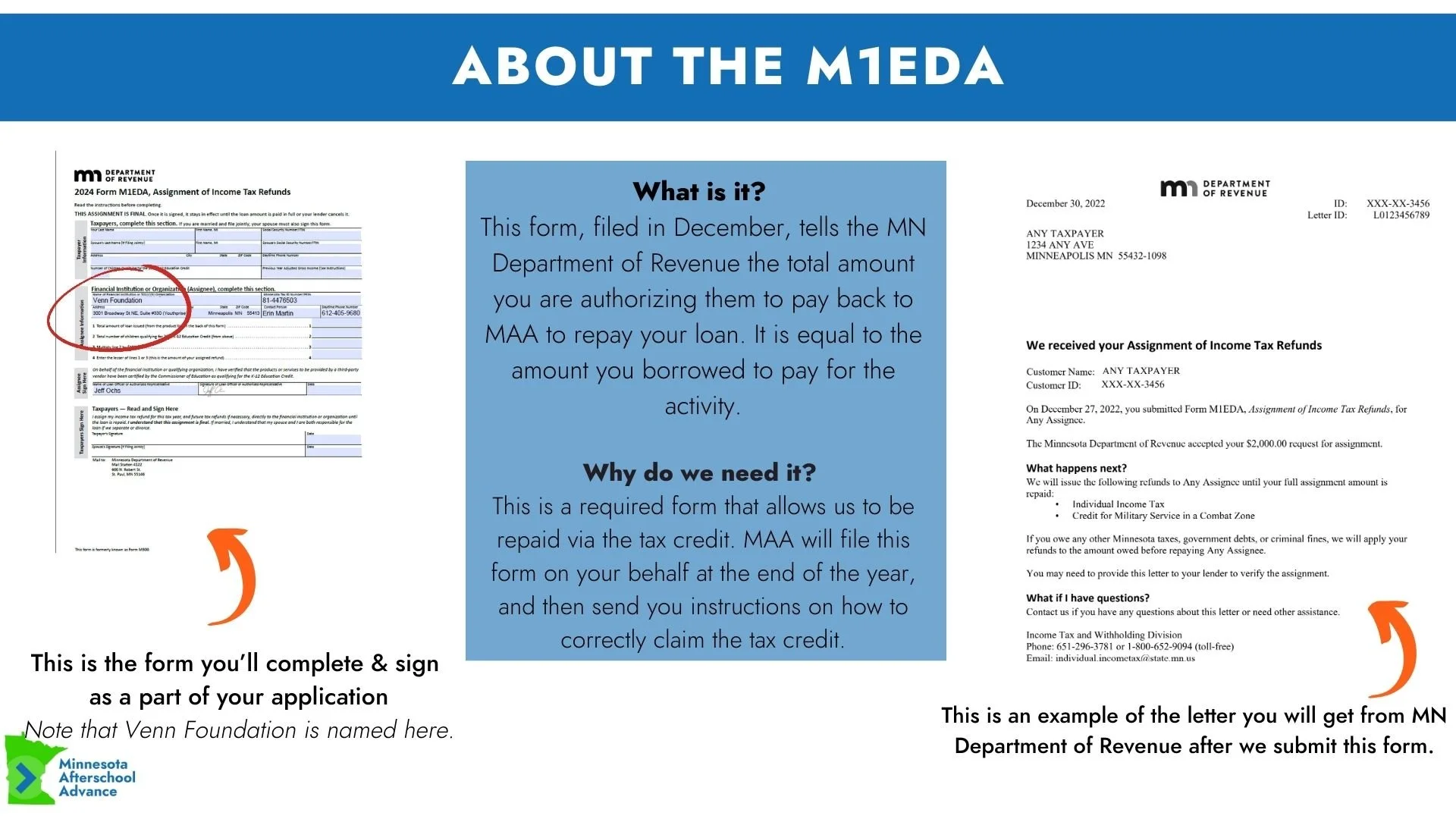

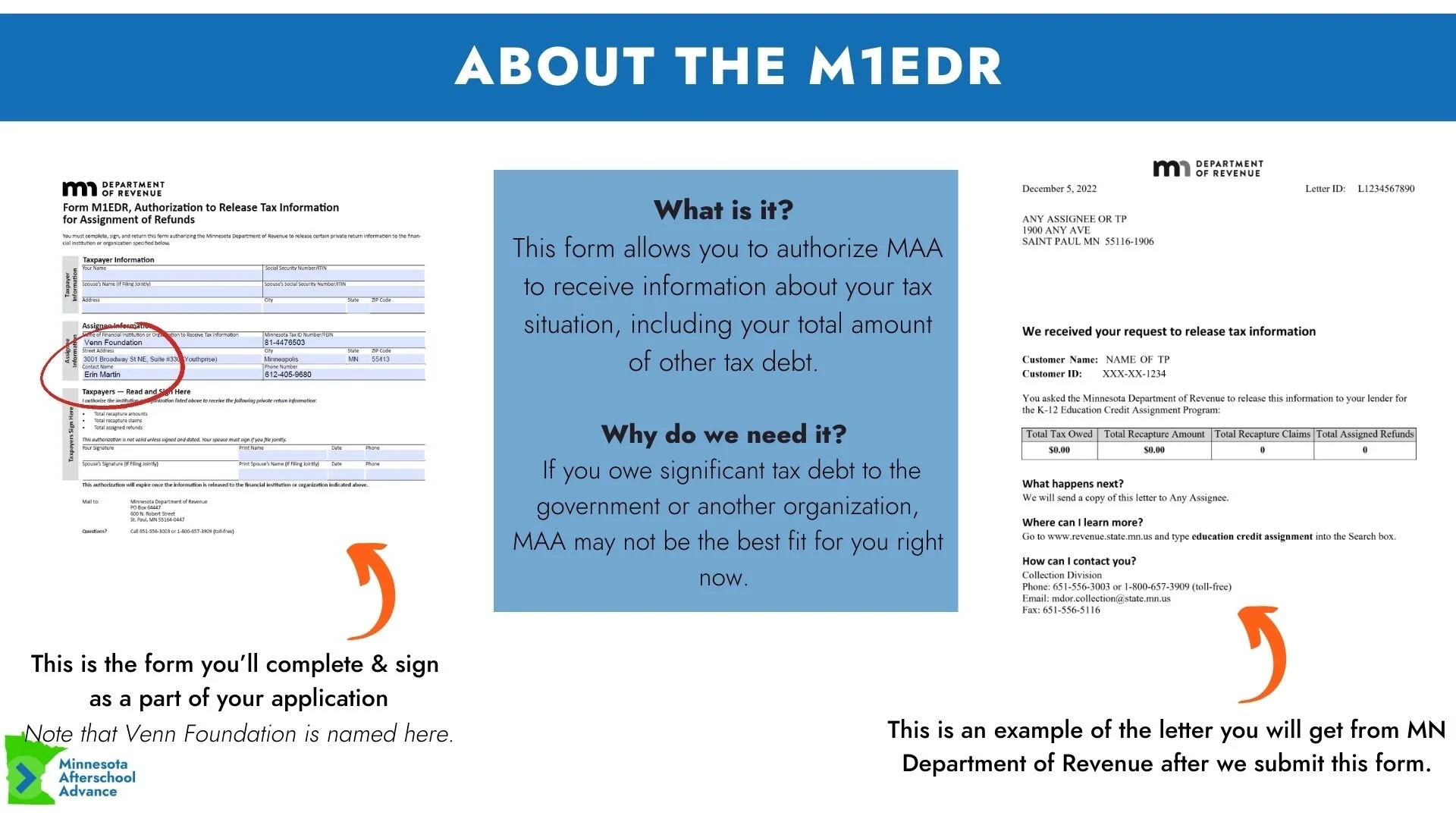

Once approved, we’ll also submit your M1EDR on your behalf to the MN Department of Revenue (MDOR). You will receive a letter from MDOR in a couple of weeks notifying you of this submission. Please see the example below for more information.

Once you’re registered and the activity has been paid for, you must:

Ensure that your child(ren) fully participate in the activities they are registered for.

Commit to filing a Minnesota income tax return for the year of enrollment in MAA. MAA has many resources available to assist you with this, including the opportunity to get your taxes done for free. Information about tax preparation will be shared near the end of 2024 and throughout the tax filing season.

Repay MAA for the amount loaned to you through your tax refund (which should include the tax credit to pay for the activities). Instructions and assistance in completing this step will be made available to you beginning in late 2024 and throughout the tax filing season.

ABOUT THE FORMS SIGNED AS PART OF THE APPLICATION :

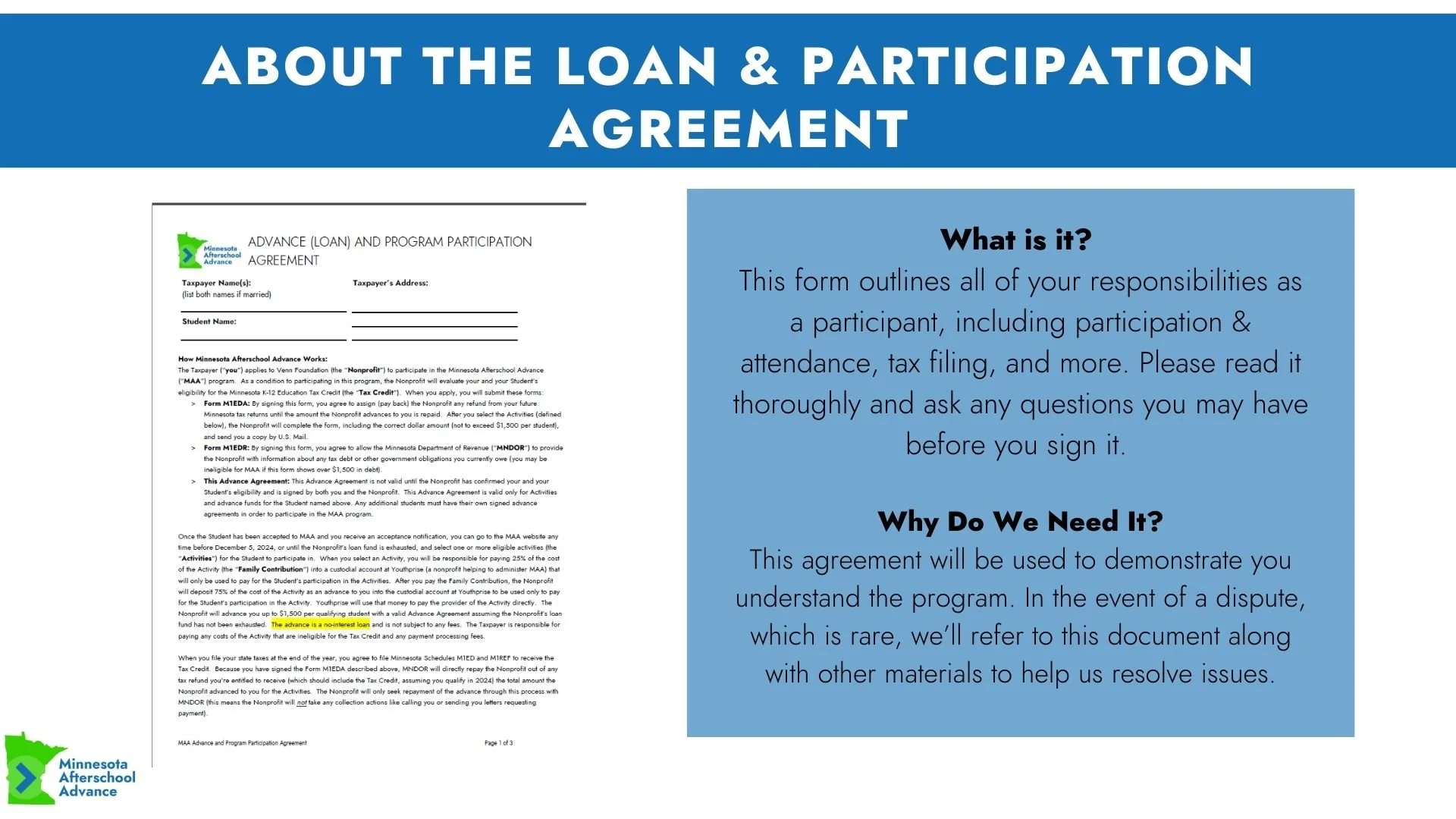

As part of the application, you signed 3 forms: the M1EDR, M1EDA, and the Loan and Participation Agreement.

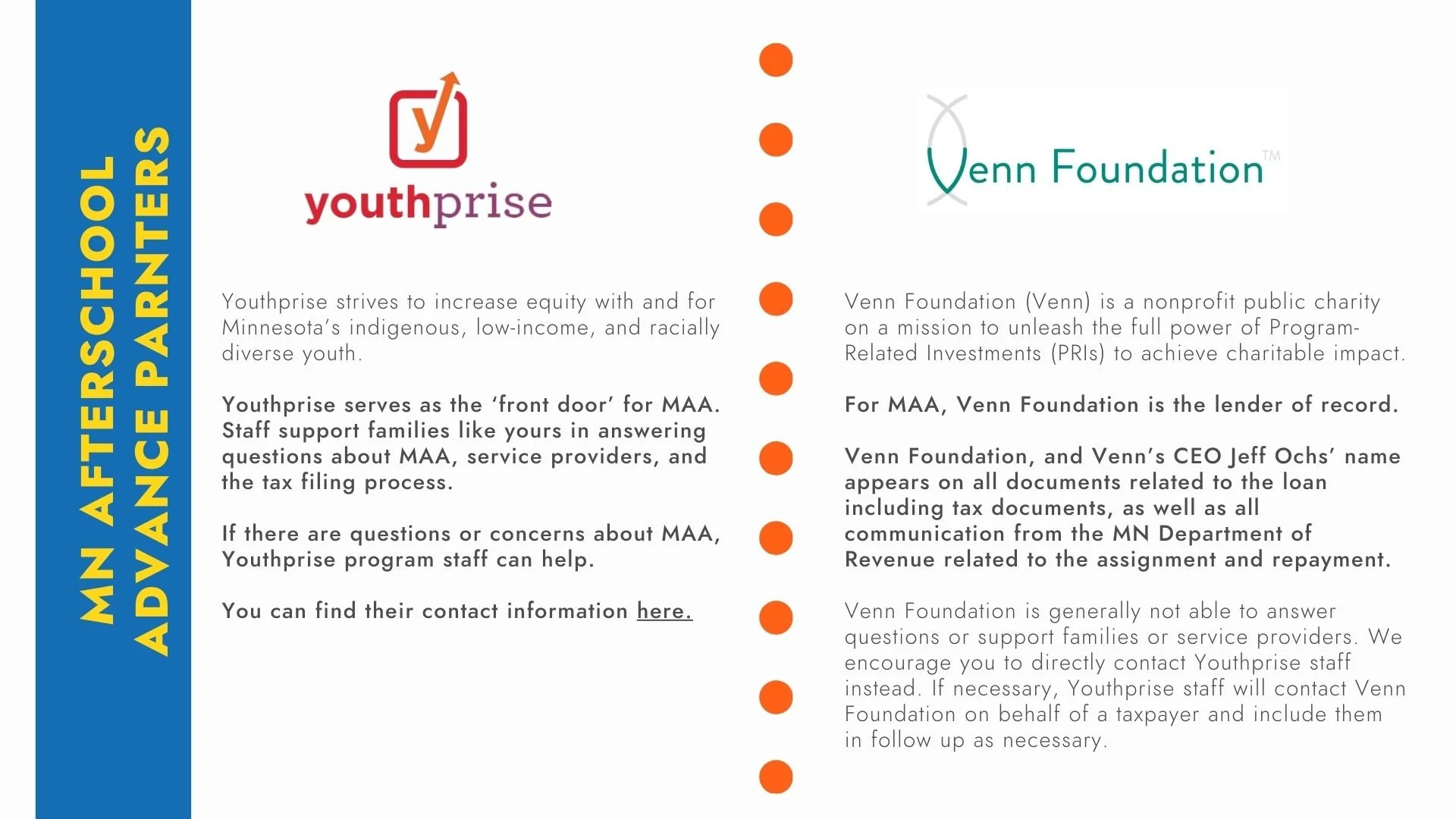

Please note that these forms will refer to Venn Foundation and Youthprise in their official capacities as MAA partners. Please learn more about the partners and the forms below.

Are you eligible for Minnesota Afterschool Advance?

Please note our eligibility guidelines, including the household income limit of $70,000 in both 2022 and 2023.

Questions about how MAA works?

Watch a short video that explains it! You can also learn more at our Frequently Asked Questions page.